A Career Built on Guidance, Not Pressure

Building a career in insurance is not about pushing products or chasing quick wins.

It’s about helping people understand their options, prepare responsibly, and make informed decisions, especially when life doesn’t go as planned.

If you’re looking for meaningful work, structured training, and long-term growth, this path may be worth exploring.

Explore if this path is right for you.

This May Be a Good Fit If You…

You don’t need to have everything figured out, but mindset matters.

This role may suit you if you:

- Are open to learning and continuous improvement

- Are comfortable explaining, not convincing

- Value trust, integrity, and long-term relationships

- Are willing to study and complete licensing requirements

- Want work that has real impact on individuals and families

Many of our advisors started as:

- Fresh graduates

- Career shifters

- Professionals looking for more meaningful work

- OFWs transitioning back to the Philippines

This Role May Not Be Right If You…

To be clear, this role is not for everyone.

It may not be a good fit if you:

- Are looking for fast or guaranteed income

- Prefer shortcuts over structured learning

- Are uncomfortable with compliance and accountability

- Expect results without consistent effort

- Are not open to feedback or mentoring

This is a professional, regulated field, and we treat it that way.

Career Path

What You’ll Actually Be Doing

This is not a “talk-only” role. You will be trained to do real work.

Your responsibilities include:

- Learning insurance and financial protection concepts

- Completing required licensing and examinations

- Helping clients understand their options clearly

- Supporting policy servicing and claims guidance

- Participating in ongoing training and mentoring

No scripts. No pressure tactics. Just clear, responsible guidance.

Training, Support, and Expectations

We provide structure, but effort is required.

You can expect:

- Guided onboarding and licensing support

- Product and process training

- Mentoring from experienced advisors

- Ethical standards and compliance-first practices

- Regular feedback to help you improve

Growth here is based on competence, consistency, and character. Not hype.

Why Some Choose This Path

People who stay in this profession often value:

- Meaningful conversations and client impact

- Professional and personal growth

- Flexibility paired with responsibility

- Long-term career potential

- Work that aligns with their values

It’s not easy, but it can be deeply fulfilling.

How This Career Can Grow Over Time

Those who stay and grow often move through stages such as:

- Financial Advisor

- Senior Financial Advisor

- Leadership or mentoring roles

Progression is earned through:

- Skill development

- Client service

- Professional conduct

- Willingness to help others grow

Titles are secondary. Capability comes first.

Two Professional Paths You Can Explore

As you read through the roles below, think less about titles and more about how you prefer to work and grow.

Insurance Advisor Track

This role is centered on client guidance and service.

Advisors focus on:

- Understanding client needs and goals

- Explaining insurance and protection options clearly

- Supporting policy servicing and claims guidance

- Building long-term client relationships based on trust

Many advisors choose to stay on this path long-term, developing deep expertise and strong client relationships.

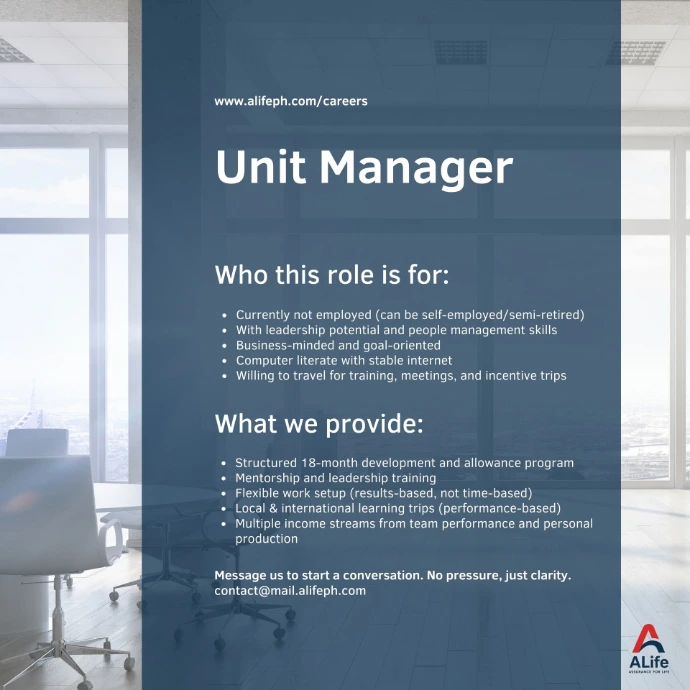

Leadership & Management Track

This path is for those who want to guide people, not just policies.

Managers and leaders focus on:

- Mentoring and training advisors

- Supporting licensing and skill development

- Maintaining ethical and compliance standards

- Helping the team grow sustainably and responsibly

You can start on this track directly, or transition to it later. The key is readiness and willingness to lead responsibly.

Global Team

Be part of a world leader in financial protection and wealth management, serving millions across more than 50 countries. Our team is backed by decades of global experience, innovation, and trust—empowering people to live better lives with confidence and peace of mind.

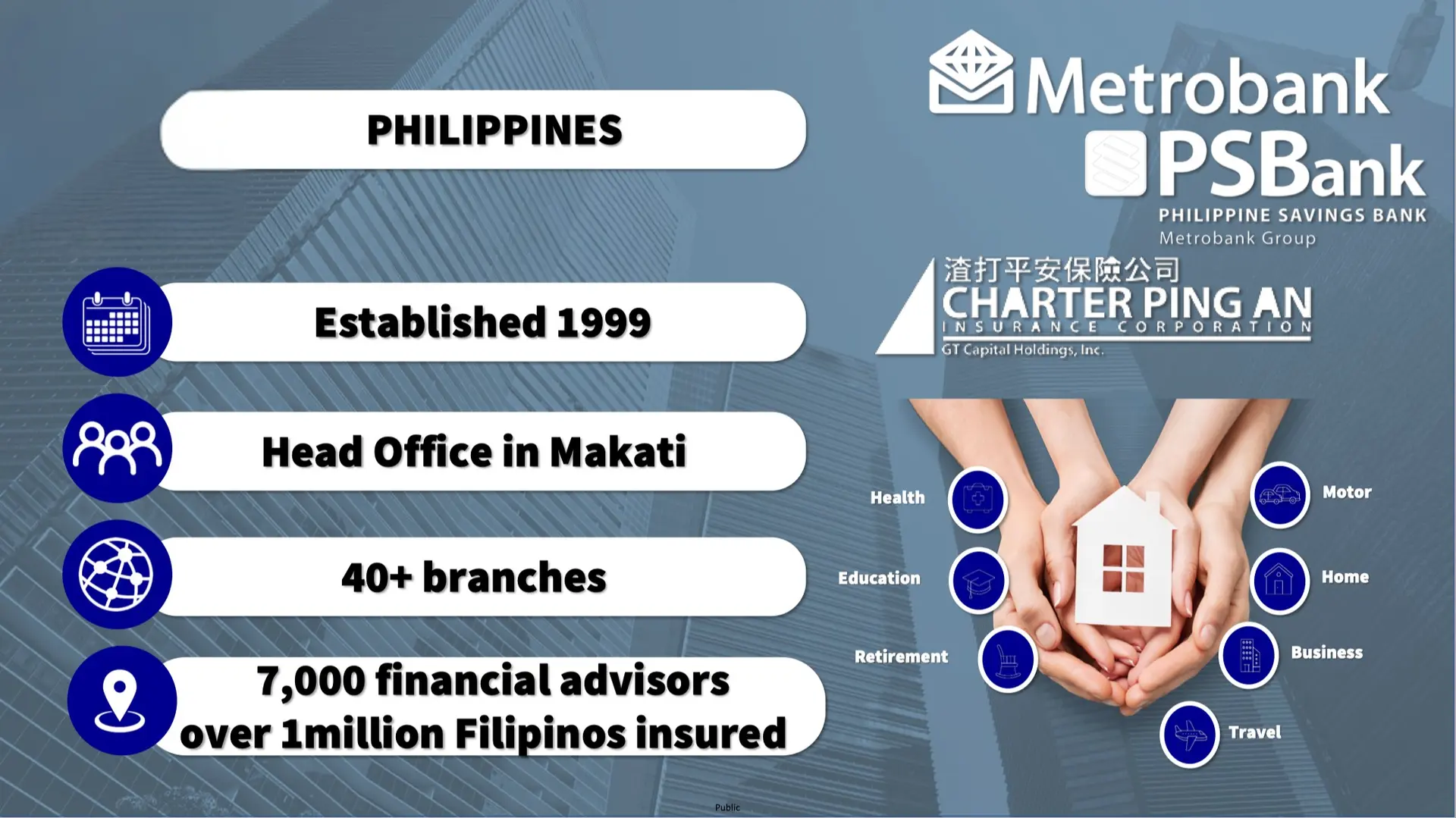

Branch Network

With six active branches and more on the way, our agency is one of the fastest-growing in the industry. We provide every branch with strong leadership, hands-on support, and the tools needed to build a thriving, goal-driven team.

Join Our Growing Team

Each year, more of our achievers qualify for global recognition trips, a reflection of our growing and winning culture. Want to be part of our next celebration? Fill out the form below or contact us to learn how you can join our team of achievers!

With Teams Nationwide

Proudly established in the Philippines in 1999, our national team has grown stronger through the years with over 40 branches and thousands of dedicated financial advisors. Together, we continue to protect and empower over a million Filipinos nationwide.

Travel Incentives

Hard work truly pays off here. Our top-performing agents and managers enjoy exclusive, all-expense-paid travel incentives. We reward dedication and excellence with unforgettable adventures around the world.

Apply Now

Ready to take the next step toward a rewarding career? Fill out the form below and send us your details — our recruitment team will get in touch to guide you through the next steps. Whether you aim to lead a team or start as a Financial Advisor, this could be the beginning of your journey with ALife.

Licensing, training, and regulatory requirements apply. This is a professional, regulated role.